The New Rules Of Money

Money Is A Problem

For everyone in America

6 Steps To Financial Security

Success begins with Financial Education

2.) Debt Management

- If you have a mortgage, auto loans, credit card balances, student loans, or other financial obligations, we put you on a plan to be debt-free within the next 8-10 years, including your mortgage.

3.) Emergency Fund

- To properly plan and be prepared for emergencies, 3-6 months of net income should be in reserve and assessable in a bank. Unfortunately, the only savings that the majority of people have is in their 401(k) or IRA, which is subject to restrictions and penalties for early withdrawal.

4.) Proper Protection

- The majority of Americans do not have enough life insurance nor do they have the right type of life insurance for their family's needs. Furthermore, as the cost of healthcare rises and we are living longer, most people are not prepared for the costs that are associated with chronic, critical or terminal illness.

5.) Build Wealth

- Long-term savings must outpace inflation and minimize taxation in order to achieve financial success. We educate clients on the many options available,

6.) Preserve Wealth

- A successful financial plan includes a strategy to reduce or eliminate estate taxes upon the transferrance of wealth from one generation to another. We use the tools and strategies of the wealthy to help Middle America keep its hard-earned money in the family.

Hope BSG empowers people with financial education on topics such as:

The Rule of 72

A basic principle on how money doubles over time

The Power of Indexed Contracts

Imagine being able to participate in the successes of the market with a zero-loss guarantee

Accelerated Living Benefits

Life insurance that you don’t have to die to use

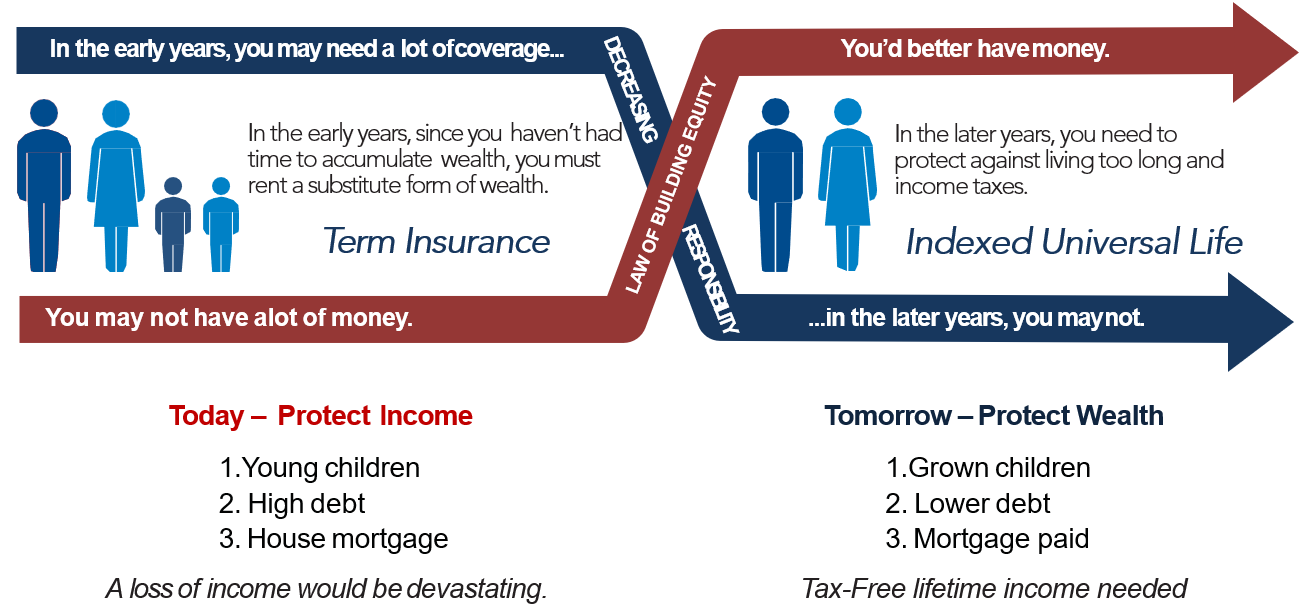

The Wealth Flow Formula

Your financial needs change over time

Accelerated Living Benefits

Protect your lifetime savings by using the leverage of Life Insurance with

Accelerated Living Benefits

Accelerated Living Benefits are essential:

We are more likely to get sick before we die

Heart attack, stroke, invasive cancer, renal failure, severe cognitive impairment, loss of 2 of 6 of our Activities of Daily Living (ADL)

Health Insurance will not cover all of your costs

Mortgage, lost wages, utilities, food, college, deductibles, co-insurance, uncovered medications & procedures

At 65 years of age, we go on Medicare

Medicare pays $0 for Long-Term Care services after the first 100 days 1

Life Insurance that you don’t have to die to use

Imagine being able to have access to your life insurance death benefit instead of using your lifetime savings for covered Chronic, Critical & Terminal illness

The Wealth Flow Formula

Your needs change in time, but you always need Accelerated Living Benefits